GAP Insurance

Parkers has partnered with MotorEasy to provide you with the UK’s best combination of price and cover GAP Insurance. MotorEasy is the easy way to manage, protect and maintain your car.

With industry leading plans for Warranty, Servicing, MOTs, GAP, Alloy Wheel and Cosmetic insurances.

MotorEasy GAP Insurance

Many drivers fail to take into account the possibility of their car being written off. Even the best insurance companies will only reimburse you for the car’s current market value. A car’s value starts to decline the moment you drive it.

In the event of a write-off, a GAP Insurance coverage supplements an insurance payout, giving you the extra cash you need to buy a replacement car or pay off any existing debt.

Get a GAP insurance quote with MotorEasy

GAP Insurance explained?

GAP Insurance covers the difference between what your insurer pays out and, depending on the type of policy, what you paid for the car or what you still owe on the car.

On average a car loses around 60% of its value in three years – the typical length of a car on finance.

So, if your new car costs £12,000 and three years later it was stolen or written off, you’d get just £4,800 from your insurer.

That’s not enough to buy the same car brand new and it’s unlikely to be enough to repay the remaining finance due to balloon payments and interest on PCP deals.

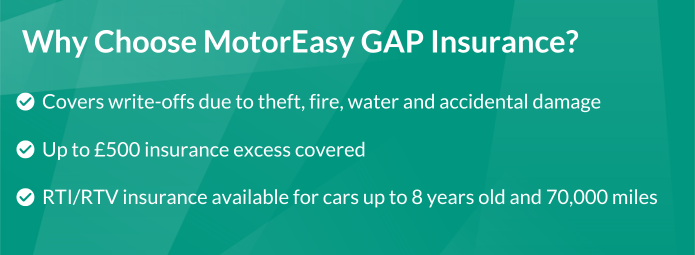

Why choose MotorEasy GAP Insurance?

We are confident we can make motoring easier for all our members. Our 5-star rated GAP Insurance is up to 75% cheaper than main dealer pricing and ensures that in the event of a write-off, you’re not caught short by your car insurer. Plus, you can manage everything via your free easy-to-use online account area.

Get a GAP insurance quote with MotorEasy

What is GAP Insurance?

In the event that your car has been written off or declared a total loss by your auto insurer, GAP Insurance, also known as guaranteed asset protection, protects you from suffering financial loss.

Your insurance will only cover the market value of your car at the time of the incident if it is stolen, damaged by fire or flood, involved in an accident, or all of the above.

A car loses 60% of its worth on average in the first three years, which exposes you to thousands of pounds in unpaid finance settlement fees or a large loss due to the depreciation of the vehicle’s value.

The GAP between the value your insurance company will pay for your car and what you paid for it or owing in finance, depending on the type of GAP Insurance you take out, can be filled by MotorEasy GAP Insurance, which bridges the GAP.