Should you pay-as-you-drive? It’s a serious question, since road pricing is being considered as a strategy to replace dwindling Treasury revenues from motoring. Those motorists that don’t drive very often would most likely relish the idea of cheaper motoring costs.

Meanwhile, freight and logistics firms, company car drivers and heavier car-use commuters will no doubt baulk at the idea that the motorist is once again being targeted to prop up the Government coffers—especially when one considers the state of some of our roads.

In this article, we break down the concept of road pricing and look at the pros and cons to such a revenue model.

What is road pricing?

Essentially, it’s a tax on driving itself – the more you use the roads, the more you will pay. However, it’s important to stress at this stage that exactly what method of charging might be introduced is far from being decided.

It’s a system that has been debated long before the current concerns around dismantling the revenue structure around fossil fuel sales, but with a clear plan to end driver’s reliance on paying at the pumps it’s become a significant concern for the treasury. Currently tax, known as fuel duty, accounts for around 52.5% of the price per litre at the pump.

A report, from the cross-party Transport Select Committee released in February 2022, revealed how much closer MPs are to finalising a strategy – and the urgency with which they want the government to act.

Our report on Road Pricing is out now.

We say the Government must act now to avoid a £35 billion fiscal black hole.

It’s time for an honest conversation on motoring taxes.

Read a summary of our key recommendations here:https://t.co/JRi2REu4nj

— Transport Committee (@CommonsTrans) February 4, 2022

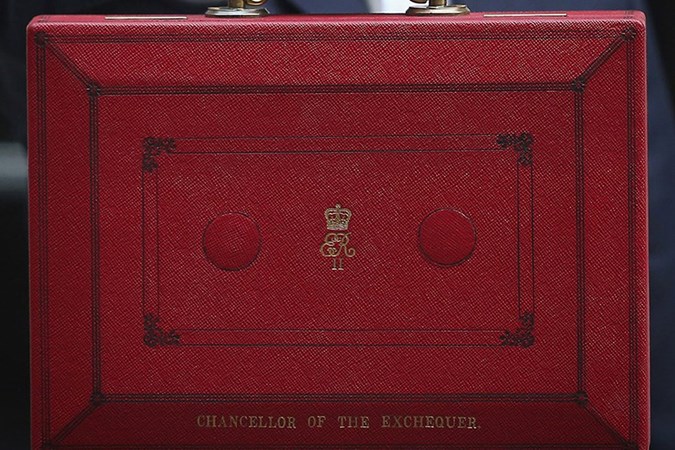

Chancellor of the Exchequer Rishi Sunak appeared in no rush to follow Prime Minister Boris Johnson’s early announcement in 2020 for a taxation shake-up – it could still be the best part of a decade away – but successful early adoption of electric cars, combined with reduced vehicle excise duty on newer cars as they age, has had a negative impact on revenues.

On a very small scale, road pricing already exists in the UK, with fees for driving in Central London’s Ultra-Low Emissions Zone (ULEZ, but commonly known as the Congestion Charge), the M6 Toll motorway and various crossings such as the Dart Charge at Dartford.

December 2023 Update

Earlier in the year, the government announced it had no plans to introduce a telematics-based road pricing scheme to replace the current vehicle excise duty system. Despite growing demand for reformation in the way we pay our road tax, Chancellor Jeremy Hunt rejected road pricing as a solution.

Conservative MP and Transport Select Committee chair Iain Stewart wrote to Mr Hunt requesting a government response to the TSC’s Road Pricing study. Mr Hunt responded by asserting that all motorists should start to pay a fairer tax contribution, referring to the government’s plans for EV owners to start paying VED tax in 2025, but maintained that ‘the government does not currently have plans to consider road pricing.’

Why has road pricing been considered?

While banning the sale of petrol- and diesel-engined cars from 2030 might please environmentalists, the reality is the drop-off in sales of those kind of vehicles will hit the Treasury’s revenues hard.

Estimates, according to The Times’ report in November 2020, are that fuel duty and VAT on petrol and diesel, combined with a slowing of income from VED car tax – presently only paid on zero-emission cars if they cost more than £40,000 new – could be as high as £40 billion.

Given the economic peril the UK already faces, this is a financial headache that a couple of paracetamol won’t relieve.

Consequently, road pricing is being toted in government circles as a way to effectively replace those existing, lucrative income streams that motorists have to pay.

How could we be charged for using the roads?

There are debates ahead about precisely how we will be charged for using the UK’s roads. There are conspiracy theories about the use of black boxes monitoring drivers’ precise movements, which don’t stand up to scrutiny, since such a move would contravene privacy legislations.

However, vehicle telematics may play a role. Acoording to the Transport Select Committee, ‘telematic technology could deliver a replacement road pricing mechanism that sets the cost of motoring based on the duration and time of the journey and vehicle type and size. The role that this technology could play in a road pricing system must be examined.’

What is more likely is that drivers will be charged for using different kinds of roads, with urban zones set at one tier, motorways at another and other road types being cheaper still, if not free to use.

Systems such as automatic number plate recognition (ANPR) and electronic tags stuck to the inside of windscreens already exist, so using similar technology could prove cost-effective.

Either way money would have to be invested in installing the necessary infrastructure for whatever system is chosen.

Is road pricing fairer?

Of all road users, it seems people living in rural communities could be hardest hit by the proposed changes.

If the price to use minor roads is significantly cheaper than dual carriageways and motorways, it could encourage thriftier motorists to take the countryside option, making them far more congested than they are presently.

This is compounded by the fact that many smaller towns and villages have poor public transport links to larger cities, giving many little option but to drive instead of taking a bus or train.

We will also be keeping a close eye on what revenue from road pricing is spent upon. Given that existing fuel duty and VED car tax money is not spent on road repairs, it seems unlikely that a percentage of road pricing income will be ringfenced for spending directly on highways.

What this means for you

Precisely who will pay any road pricing charges will not be confirmed until nearer the time plans are finalised, with various options up for consideration. It’s clear that the MPs debating the issue are keen to ensure drivers are not worse off as a result.

The Transport Select Committee says ‘The Government must ensure that any new motoring taxes entirely replace fuel duty and vehicle excise duty, rather than being added alongside those taxes, so that motorists pay the same or less than they do currently.’

It could be that only drivers of zero-emission cars – those running on electricity or hydrogen – will pay the new tax, with petrol and diesel vehicle drivers continuing to pay duty on the fuel itself. Alternatively, that levy could be scrapped so that road pricing applies to all drivers.

FAQs

-

What is road pricing to reduce congestion?

Road pricing has already been introduced in different forms to reduce congestion. The London ULEZ, for example, is a road pricing initiative that was set up to incentivise people not to drive through London if their car does not meet emissions standards, thus reducing congestion and improving air quality as a result. The Road Pricing study propositioned wider road pricing adoption to encourage active travel rather than cheap motoring, getting more cars off the road to improve congestion.

-

What is the road pricing tax?

Road pricing tax is a pay-as-you-go charge for drivers to use roads. A road pricing tax would apply to all motorists including those who drive zero-emissions vehicles that don’t currently pay any road tax. It has been suggested that such a scheme would generate more funding for road maintenance while incentivising people to use other transport methods to reduce congestion.

Just so you know, we may receive a commission or other compensation from the links on this website - read why you should trust us.