As a disabled driver, you could be eligible for a 50% road tax reduction if you receive certain benefit payments. There are even road tax exemptions available to some people, as well. And you might qualify for a blue badge, which allows various parking concessions.

We should clarify that, when we say ‘road tax’, we’re talking about vehicle excise duty (VED). Road tax and car tax are frequently used colloquial terms for VED.

In this guide, we’re going to cover exactly what road tax reductions and exemptions are available and to who. We’ll also look at the application processes for them.

Am I eligible for road tax reduction/exemption?

A 50% reduction in the cost of vehicle road tax is available to people who receive the following benefits:

- Personal independence payment (PIP) standard rate mobility component in England, Wales and Northern Ireland

- Adult disability payment (ADP) standard rate component in Scotland.

Unfortunately, people who receive the disabled living allowance (DLA) lower rate mobility component aren’t eligible. Remember that the vehicle being taxed must be registered in the name of the disabled person who receives benefits, or their nominated driver. If you need to change the car’s registered keeper, check out our page on the process.

A 100% vehicle road tax exemption is available to people who receive the following benefits:

- PIP enhanced rate mobility component

- DLA higher rate mobility component

- War pensioners mobility supplement (WPMS)

- Armed forces independence payment (AFIP)

The vehicle being taxed must be registered in the name of the disabled person or their nominated driver. However, the vehicle must only be used for the disabled person’s benefit – a nominated driver isn’t allowed personal use of the vehicle.

How to claim your road tax reduction

The process for claiming reduced road tax isn’t the work of a moment, but it doesn’t have to be a bureaucratic nightmare if you have easy access to the necessary paperwork. Once you’ve collated it all together, it must be posted to DVLA, Swansea, SA99 1BF.

Here’s what you need:

- If you live in England, Wales or Northern Ireland, a letter or statement from the Department for Work and Pensions (DWP) showing your name and address, the PIP rates you receive and the date you started receiving it.

- If you live in Scotland, your ADP decision letter from Social Security Scotland showing your mobility component rate and the date you started receiving it.

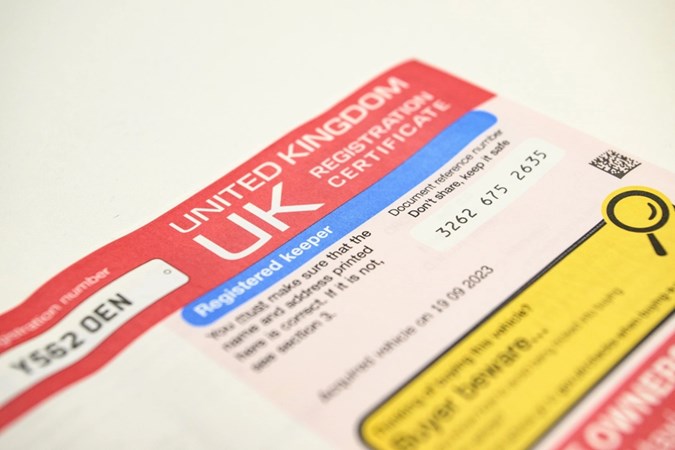

- Your car’s V5C registration document.

- A copy of your car’s current MOT certificate (if it’s more than three years old).

- A completed application for vehicle road tax (DVLA form V10, available from any Post Office).

- A cheque or payment order (made out to DVLA, Swansea) for 50% of the full road tax rate your vehicle incurs. You can use the Parkers car tax calculator to work out the amount.

If you’ve just bought your vehicle and it isn’t yet registered in your name or that of your nominated driver, you need to include a completed vehicle registration certificate application (DVLA form V62, available online or from any Post Office) and the section 6 new keeper slip from your vehicle’s V5C registration document.

Do not include a copy of your PIP assessment or any medical information with your application.

What to do if your vehicle is not registered to you or your nominated driver

You can apply for reduced road tax for any vehicle that you have regular use of, even if it’s not registered to you or your nominated driver. The vehicle could be made available to you by a family member, for instance.

If that’s the case, you need to include a signed letter from the vehicle’s registered keeper with your application. The letter should explain how they know you and how the vehicle will be used – such as going shopping or collecting prescriptions.

Remember that processing an application for reduced road tax takes some time, so you might not receive a decision until after the vehicle’s current road tax has expired. Of course, the vehicle must be taxed to be legal for use on the road, so you may have to pay the full rate and apply for a refund later. Include proof of payment or a letter stating when payment was made with your application.

How to apply for road tax exemption

If you receive benefits that entitle you to road tax exemption, you should have a Certificate of Entitlement. If you don’t already have one, make sure you get on from the agency that administers your benefits.

If you’re buying a new vehicle, take your certificate with you to the supplying dealer and they will process the admin for you. If you’re going through a leasing company, get in touch with their customer services department to find out what their procedure is for dealing with the situation. The Motability scheme handles it all for you.

If you’re applying for exemption for a vehicle you already own, or a used vehicle that’s new to you, you need to change its taxation class from private light goods (PLG) to limited use. You can do that at any Post Office with the following documentation:

- Certificate of entitlement to qualifying benefit.

- The V5C registration document, or the nominated driver’s details.

- A completed vehicle registration certificate application (DVLA form V62).

Once you’ve applied for road tax exemption, you can deal with the annual renewal online or by phone. Annoyingly, you do still have to ‘pay’ the sum of £0.00 so the car is properly recorded in the DVLA’s system.

Are blue badge holders entitled to road tax reduction/exemption?

If you have a blue badge disabled parking permit, you’re almost certainly entitled to a 50% reduction in the cost of your vehicle road tax, or an exemption. If you’re unsure, contact your benefits agency to find out.

Blue badge holders are also entitled to the following concessions:

- Access to designated disabled parking spaces, often free of charge and with extended time limits.

- Exemption from some parking restrictions such as time-limited parking bays.

- Access to certain pedestrianised zones.

Specific benefits vary between local authorities, which are able to set their own concessions for blue badge holders.

FAQs

-

Are blue badge holders exempt from road tax?

If you have a blue badge disabled parking permit, you’re almost certainly entitled to a 50% reduction in the cost of your vehicle road tax, or an exemption. If you’re unsure, contact your benefits agency to find out.

-

Which cars are exempt from road tax?

As discussed in this article, vehicles used by people who receive certain disability benefits are exempt from road tax. However, they’re not the only ones that are. Classic cars more than 40 years old are, as well, which means any car built during or before 1985 at the time of writing. Owners of those vehicles have to apply for exemption and renew it every year. In the past, vehicles with CO2 emissions of less than 100g/km incurred road tax at a rate of £0, effectively making them exempt. However, as of April 2025, those cars now incur an annual charge of £20, unless the owner/driver is entitled to an exemption.

-

Are electric cars exempt from road tax?

Prior to April 2025, electric cars incurred road tax at a rate of £0, effectively making them exempt. However, they now incur an annual charge of £20 unless the owner/driver is entitled to an exemption.

Just so you know, we may receive a commission or other compensation from the links on this website - read why you should trust us.