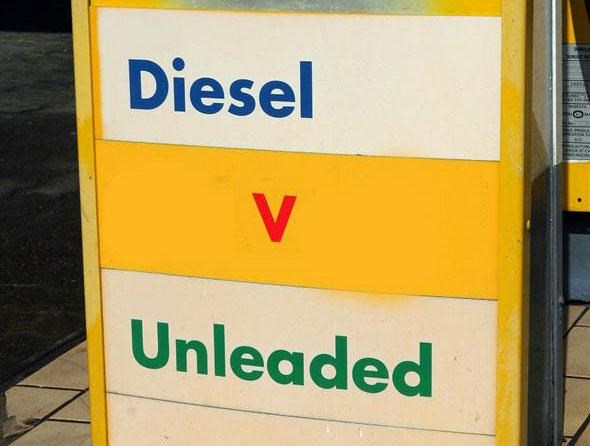

Diesel power is often the default choice for company car drivers, but under certain circumstances a petrol-powered car would actually fit the bill far better.

Although diesel works well for those doing more miles with larger cars, there are several factors which make petrol cheaper in many other situations.

Benefit-in-kind taxation

The primary reason many company car drivers will benefit (pun intended) from driving a petrol car is the three percent surcharge levied on diesel-powered cars. Introduced in 2002, the levy was brought in to recognise the fact that while CO2 levels are lower for diesel cars, the other emissions they pump out are actually more harmful.

This isn’t actually the case nowadays, since the vast majority of diesel cars on the road have a Diesel Particulate Filter (DPF) which sieves out many of the harmful gases. The levy still stands, however, which means that a petrol car with the same CO2 emissions and P11d value as a diesel car will be cheaper to tax.

P11d value loading

Bearing in mind the previous point, what we find is diesel models are actually more expensive to buy than petrol cars. This means tax is pushed higher still.

For example, a Ford Focus Edge fitted with a 1.6-litre petrol engine will cost you £16,305. The equivalent diesel-powered model costs £17,395.

That means over £1,000 extra just to have the diesel.

Of course the CO2 emissions are more for the petrol (136g/km compared to 109g/km for the diesel) but the point still stands – diesel cars are more expensive to buy.

So when is petrol actually cheaper?

We’ve set out a few case studies to show some instances when petrol is cheaper than diesel for a company car driver.

Crucially, while they use different fuels their performance is fairly similar.

Case study 1: the Ford Fiesta

Version: 1.0-litre EcoBoost engine

P11d value: £14,890

CO2 emissions: 99g/km

BIK: 11%

Fuel economy: 67.5mpg

Range: 623 miles

Monthly tax bill at 20%: £27

Version: 1.6 TDCi diesel engine

P11d value: £16,290

CO2 emissions: 87g/km

BIK: 13%

Fuel economy: 85.6mpg

Range: 791 miles

Monthly tax bill at 20%: £35

Case study 2: the Volkswagen Golf

Version: GT 1.4 TSI ACT DSG

P11d value: £24,530

CO2 emissions: 110g/km

BIK: 14%

Fuel economy: 60.1mpg

Range: 661 miles

Month tax bill at 20%: £57

Version: GT 2.0 TDI DSG

P11d value: £25,035

CO2 emissions: 119g/km

BIK: 18%

Fuel economy: 62.8mpg

Range: 691 miles

Month tax bill at 20%: £75

Case study 3: the Peugeot 508 saloon

Version: 1.6 THP (156bhp) Active

P11d value: £21,160

CO2 emissions: 144g/km

BIK: 20%

Fuel economy: 45.6mpg

Range: 722 miles

Monthly tax bill at 20%: £71

Version: 2.0 HDi (163bhp) Active

P11d value: £23,160

CO2 emissions: 149g/km

BIK: 24%

Fuel economy: 49.6

Range: 786 miles

Monthly tax bill at 20%: £93

Fuel for personal use

It’s worth bearing in mind that fuel costs will make a difference if you pay for your own fuel for personal use. Diesel is more expensive to buy, but because diesel cars are generally more fuel-efficient they’re likely to cost you less in fuel costs, which may affect your monthly budget if you have to pay for your own fuel for personal use.

Just so you know, we may receive a commission or other compensation from the links on this website - read why you should trust us.