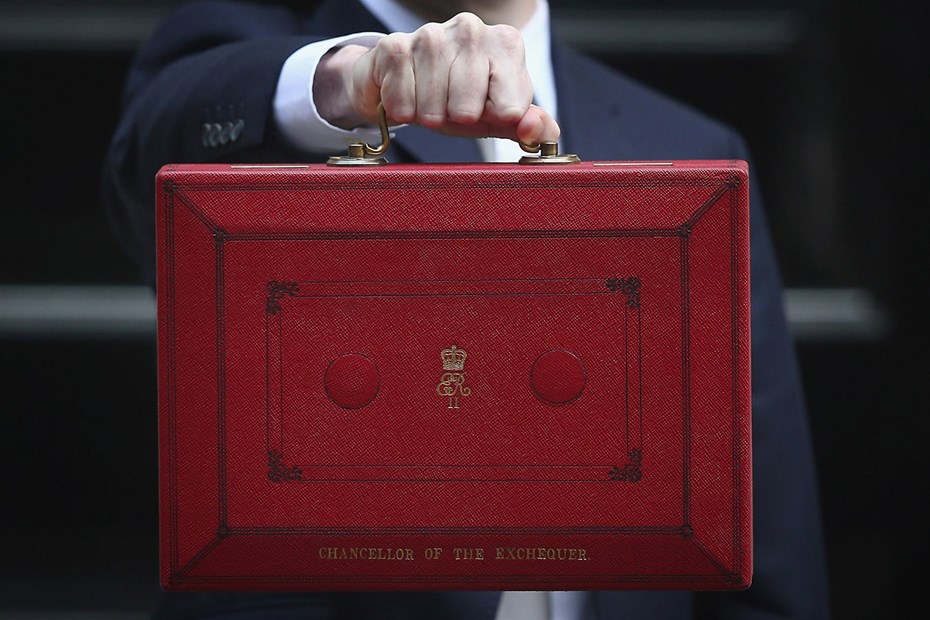

The 2020 Budget brings good news and bad news for van owners and operators in the UK, as the government moves to incentivise the sale of electrified vans and has committed to freezing fuel duty for the 10th year in a row.

2020 Budget makes electric vans cheaper

Electrified vans are being made more attractive in two ways in the 2020 Budget.

Firstly, the Plug-in Van Grant is being extended until at least 2022-23, thanks to the provision of a further £129.5 million to pay for it (this also covers Plug-in Taxis and Plug-in Motorcycles).

The PiVG, as it’s known, is the van equivalent of the Plug-in Car Grant (PiCG), and offers buyers of vans that can travel some distance on electric power alone a discount of up to 20% of the list price, up to a maximum of £8,000.

Vans that are eligible include full-electric models such as the Nissan e-NV200, Mercedes-Benz eVito and Renault Kangoo ZE, as well as the part-electric Ford Transit Custom Plug-In Hybrid and the Mitsubishi Outlander PHEV Commercial.

The second incentive applies to pure electric vans only, and will see the van benefit charge reduced to zero – that’s nil, £0 – from April 2021, saving businesses an estimated £433 per van. Currently the van benefit charge is 60% of a diesel van.

What about tax on ordinary vans – and pickups?

This is the slightly bad news. For although fuel duty – which affects the cost of every litre at the pumps – is being frozen for all vehicles, other forms of van tax are going up. Albeit not by very much.

VED (Vehicle Excise Duty) road tax will increase in line with the Retail Price Index (RPI). We don’t have exact figures for this yet, but since vans and pickups are charged at a flat rate that’s already very attractive compared with most cars, this won’t be a big deal for most people or businesses.

Similarly, fuel benefit charge and van benefit charge of conventional (non-electric) vans will increase in line with the Consumer Price Index (CPI). Again, this won’t make a massive difference, and we’re waiting on the official figures.

Any other van-related 2020 Budget news?

Related to vans, VED road tax on new motorhomes is being moved to a flat rate, which as of 12 March 2020 will be £265, before going up to £270 in April when the 2020-2021 tax year begins.

Then in April 2021 it will become aligned with the flat rate applied to vans (no figures for that yet as it’s still a year away).

This will potentially bring big savings for motorhome buyers.

Any changes for pickup tax in the 2020 Budget?

Not at all – which means that as long as they qualify as a commercial vehicle they will continue to enjoy all the fixed-rate taxation levels as vans.

Which will continue to make them very attractive as an alternative to conventional company cars.

You can read the full official 2020 Budget on the UK government website.

Also read:

>> The Parkers guide to van and pickup tax

>> The Parker guide to electric vans

>> Budget news on Parkers Cars

Just so you know, we may receive a commission or other compensation from the links on this website - read why you should trust us.