The UK government has relaxed sales targets for zero emissions vehicles (ZEVs) – primarily concerning electric cars (EVs) – in response to the effects of trade tariffs imposed by the US government. The ZEV sales mandate came into force at the start of 2024 as a key driver in the shift away from petrol and diesel cars towards EVs.

As well as being a response to the rapidly-changing economic situation across the globe, the tweaks to the ZEV mandate have been introduced as a result to the recent consultation into this legislation. In a nutshell, government has confirmed that hybrids will remain on sale until 2035, specialist low-volume British car manufacturers are exempt from the mandate, and the punitive fines for carmakers missing these targets have been reduced.

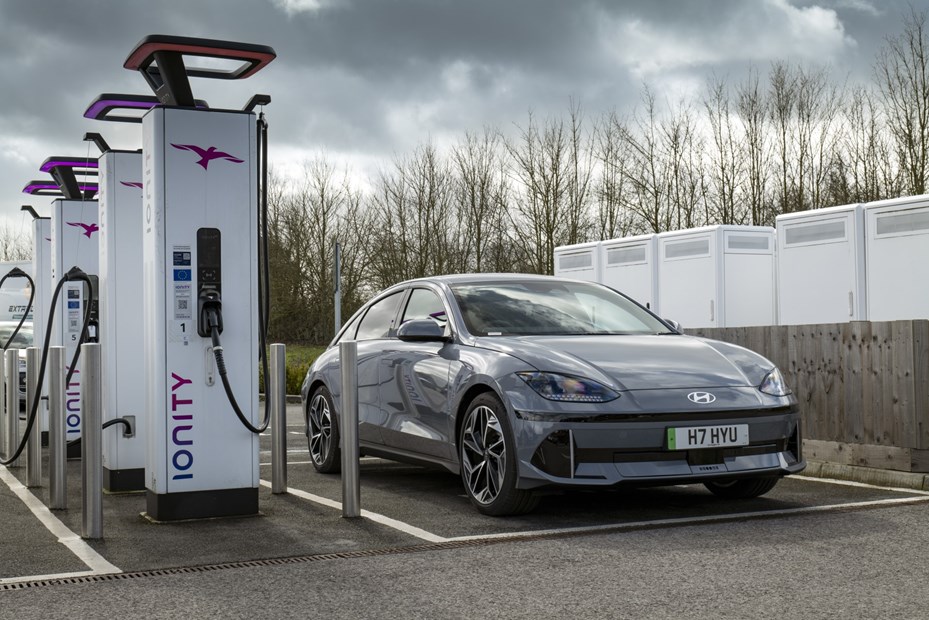

Here, we’re going to look at exactly what the ZEV sales mandate is, why it’s necessary, how it’ll work in practice and how it’s likely to affect you, as a consumer. We’ll also cover the government’s response to manufacturer pleas for extra support.

What is changing with the ZEV sales mandate?

The mandate is a minimum ZEV sales target that the vast majority of manufacturers that sell cars in the UK will have to meet. The target is a percentage of a manufacturer’s overall registrations in a calendar year. In 2024, that target is 22%. So, if Manufacturer X sold 100,000 cars in the UK in 2024, it needed to sell at least 22,000 ZEVs.

Full details of how the targets are to change have yet to be released, but previously they were planned to go up every year, reaching 100% in 2030 when the sale of new petrol and diesel cars were set to be banned. The government has also confirmed that petrol and diesel vans can stay on sale through to 2035, along with hybrid and PHEV vans.

Mike Hawes, SMMT chief executive, supports the easing of the mandate: ‘The government has rightly listened to industry and recognised the intense pressure manufacturers are under. Growing EV demand to the levels needed still requires equally bold fiscal incentives, however, to give motorists full confidence to switch.

‘We await full details of the regulatory amendments but, given the potentially severe headwinds facing manufacturers following the introduction of US tariffs, greater action will almost certainly be needed to safeguard our industry’s competitiveness. In this vastly changed world, a package of measures is needed to support manufacturing, especially the supply chain, so our industry can deliver the economic growth, jobs and investment the country needs.’

Which cars are included in the ZEV sales mandate?

We should note that though the government calls the targets the zero-emissions vehicle sales mandate, it’s primarily electric vehicles that are currently covered by it. But other types of ZEV, such as hydrogen fuel cell vehicles, will also count towards it as and when they’re available.

The government has kept qualifying criteria as simple as possible, stipulating just three that a car must meet to count towards the mandate. It must produce tailpipe emissions of 0g/km, as measured on the WLTP test cycle; it must have a WLTP range of at least 120 miles; it must have a battery warranty of eight years or 100,000 miles (whichever comes first), and the manufacturer must guarantee they will replace the battery if its capacity drops below 70%. Virtually all electric cars currently on sale in the UK meet those criteria.

There are a number of exceptions to the mandate, covering types of vehicle for which there are currently few viable electric alternatives. They include wheelchair accessible vehicles, hearses and motorhomes. However, those vehicles still have to switch to electric by 2030.

Which manufacturers are included in the ZEV sales mandate?

Not all manufacturers that sell cars in the UK are included in the mandate; it only applies to those that register more than 2,500 cars per year in the UK. That means the likes of Ferrari and Rolls-Royce can carry on as they are, at least for the time being. That 2,500 threshold will reduce as we approach the 2030 ban on new petrol and diesel cars, but many of the manufacturers affected will have switched to an all-EV range by then anyway.

The 2030 ban for so-called micro-manufacturers that register fewer than 1,000 cars per year has also been eased. Manufacturers of more ‘specialist’ cars like Caterham, Ariel and Pagani will be able to continue selling petrol-powered machinery after 2035. Further information about this will be released.

How will the ZEV sales mandate work for consumers?

It’s hard to predict at this stage exactly how the ZEV mandate will affect consumers, but there are a number of possible scenarios we can extrapolate. We’re not going to pass judgement on how likely any of these scenarios are, but they could happen.

You may not be able to buy the car you want

While there are many manufacturers that will have no trouble meeting the ZEV mandate target, there are others that could face difficulty, at least in the early years. For instance Toyota and Ford, which currently have few EVs in their model line-ups.

It’s possible that those manufacturers could restrict sales of non-ZEVs, essentially by periodically making them unavailable, or only available in limited numbers. So, you may go out intending to buy a Ford Kuga and find you can’t get one, but you could drive away in a Mustang Mach-E there and then.

Bagging a bargain EV is easier

The Society of Motor Manufacturers and Traders (SMMT) predicts that £2 billion will be spend discounting EVs in 2024. Scary and expensive times for car makers then, but good news for bargain hunters. Just take a quick look at our Deal Watch page to see the state of the leasing industry. There are loads of cheap EV leasing deals as manufacturer’s pile on the discounts in order to try and reach the mandate.

Leasing rates for EVs are still slightly more expensive than petrol or diesel counterparts on the whole, but price parity is being met more and more. We’re even starting to see EVs undercut petrol alternatives. In particular, Volkswagen and Vauxhall – two brands who look like they’ll miss the target – are offering fantastic EV deals. The Volkswagen ID.3 is cheaper to lease than an equivalent Volkswagen Golf for example. Equally, an EV Vauxhall Mokka-e undercuts the petrol version by a healthy margin.

Increased waiting times for non-ZEVs

Car manufacturers are very good at predicting how many cars they will sell each year in an individual country. Therefore, they can work out how many EVs they’ll need to register in the UK to meet the mandate target.

If Manufacturer X expects to register 100,000 cars in the UK in 2024, it knows that 22,000 of them must be ZEVs and schedules production at its factories accordingly. That may mean production of non-ZEV models has to wait while Manufacturer X fulfils its legal obligations. As a result, deliveries of those non-ZEVs to customers take longer.

It’s also possible manufacturers will build and pre-register as many ZEVs as possible to meet their targets in one big batch. Those cars would be available for immediate delivery but, again non-ZEVs could be delayed.

Rise of the car clubs

Car clubs can be a great way of having access to a car without actually owning one. There are many of them that operate in different ways; the best have a wide selection of cars in convenient locations that can be booked through an app. You only have to pay an annual membership fee, plus any extra charges you incur.

Under the EV sales mandate, manufacturers can earn extra credits by selling cars to officially registered car clubs. Where a retail or fleet sale earns one credit, a car club sale earns 1.5 credits. As those extra credits will have a fairly significant monetary value, it’s possible manufacturers will look to sell as many EVs to car clubs as possible. We’ll explain exactly what credits are in a bit.

The number of cars and locations available from existing car clubs could increase and new players could enter the market. As a result, joining a car club could become a viable alternative to ownership for more people.

Falling used EV values

This is already a concern, independent of the EV sales mandate. Demand for used EVs is currently pretty low and large numbers of ex-fleet ones are expected to come onto the market in the next year or so. However, the companies involved won’t simply dump them all into dealers, which would have a catastrophic effect on residual values.

Some will be drip-fed into the system, others will be bought back by their manufacturer and leased again as used cars. That will continue as the ZEV sales mandate increases the number of EVs coming onto the used market, ensuring residual values stay roughly at the expected levels. There’s nothing new in that, though. It has happened for decades with non-ZEV cars, vans, lorries and every other vehicle that companies buy in large quantities.

The used EV market will inevitably grow and mature over the coming years as the supply as cars increases and buyers’ confidence in them improves. However, there are a few things that buyers may want to bear in mind in the short- to medium-term.

Cars that have been drip-fed onto the used market may have been sat idle for some time and their condition will have deteriorated as a result. And more manufacturers may attempt to operate a Polestar-style closed loop system, keeping cars within their own dealer networks by re-leasing them until the end of their lives, reducing the number of independent dealers in the process.

No doubt there are other potential scenarios that haven’t emerged yet; it really is too early to say anything definitive.

How will the ZEV sales mandate work for manufacturers?

This is where the ZEV mandate gets complicated, enough to keep an army of auditors, accountants and lawyers heavily occupied. So we’ll try to keep it simple.

Manufacturer X registers a total of 100,000 cars in the UK in 2024. With an EV sales mandate target of 22%, it can register no more than 78,000 non-ZEV cars – that’s petrol, diesel and the various sorts of hybrid. In the jargon of the mandate, each of those non-ZEV cars is called an allowance.

If Manufacturer X goes over its 78,000 allowances and registers 80,000 non-ZEV cars, it faces a fine of £15,000 for each of the excess cars – that’s a hefty total of £30 million.

However, if Manufacturer X beats the target and only sells 70,000 non-ZEV cars, it is credited an extra 8,000 allowances. Those allowances can be banked and used to sell fewer EVs than the mandate demands in future years, or it can sell them to another manufacturer.

That, of course, means Manufacturer X can buy allowances from a rival if it believes the EV mandate target will be missed. It could also borrow allowances from the government, to be paid back with interest by exceeding the targets. It’s worth noting that government won’t set the price allowances can be bought and sold for.

Several manufacturers can pool their allowances if they’re linked by a single registered company. However, groups like Stellantis wouldn’t be able to pool the allowances of its brands because each one is currently a separate company in the UK.

Is the ZEV sales mandate really necessary?

EV sales have been increasing steadily over the last few years; at the time of writing, they account for about 18.5% of all new car sales in the UK. However, the government feels that natural market forces are insufficient to drive EV sales to the required levels. Therefore, it’s felt that the mandate is necessary to facilitate the growth needed.

Can manufacturers meet this target?

The adoption of ZEVs across the entire sector has not been quick enough. ZEVs had an overall market share of 18.5% in 2024. Each month record ZEVs are registered, but uptake hasn’t been quick enough for each brand to reach future targets. For 2025, the target was to be 28% of the market, but ZEVs are currently accounting for about 20%. Plenty of brands are in pretty good shape for the mandate, but there are a lot some big manufacturers who look like they’ll miss the target and face substantial fines.

In response to pressure from manufacturers fearing fines, the government has announced a fast-track consultation on the mandate, but there are no concrete plans as of yet. The business secretary, Jonathan Reynolds confirmed that the 2030 ban on non-ZEV vehicles isn’t changing but did admit the mandate ‘wasn’t working at the moment.’

Just so you know, we may receive a commission or other compensation from the links on this website - read why you should trust us.